Business Insurance in and around Staten Island

One of the top small business insurance companies in Staten Island, and beyond.

Insure your business, intentionally

- Kings County

- Queens County

- Manhattan

State Farm Understands Small Businesses.

It takes courage to start your own business, and it also takes courage to admit when you might need a hand. State Farm is here to help with your business insurance needs. With options like errors and omissions liability, extra liability coverage and business continuity plans, you can rest assured that your small business is properly protected.

One of the top small business insurance companies in Staten Island, and beyond.

Insure your business, intentionally

Surprisingly Great Insurance

Your company is special. It's where you earn a living and also how you build a life—for yourself but also for your loved ones, and those who work for you. It’s more than just a facility or a store. Your business is your life's work. Doing what you can to keep it safe just makes sense! And one of the most reasonable things you can do is to get outstanding small business insurance from State Farm. Small business insurance covers a variety of occupations like a dog groomer. State Farm agent Dominick Abramo is ready to help review coverages that fit your business needs. Whether you are a barber, an electrician or a podiatrist, or your business is an antique store, a hobby shop or a vet hospital. Whatever your do, your State Farm agent can help because our agents are business owners too! Dominick Abramo understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Contact agent Dominick Abramo to discuss your small business coverage options today.

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

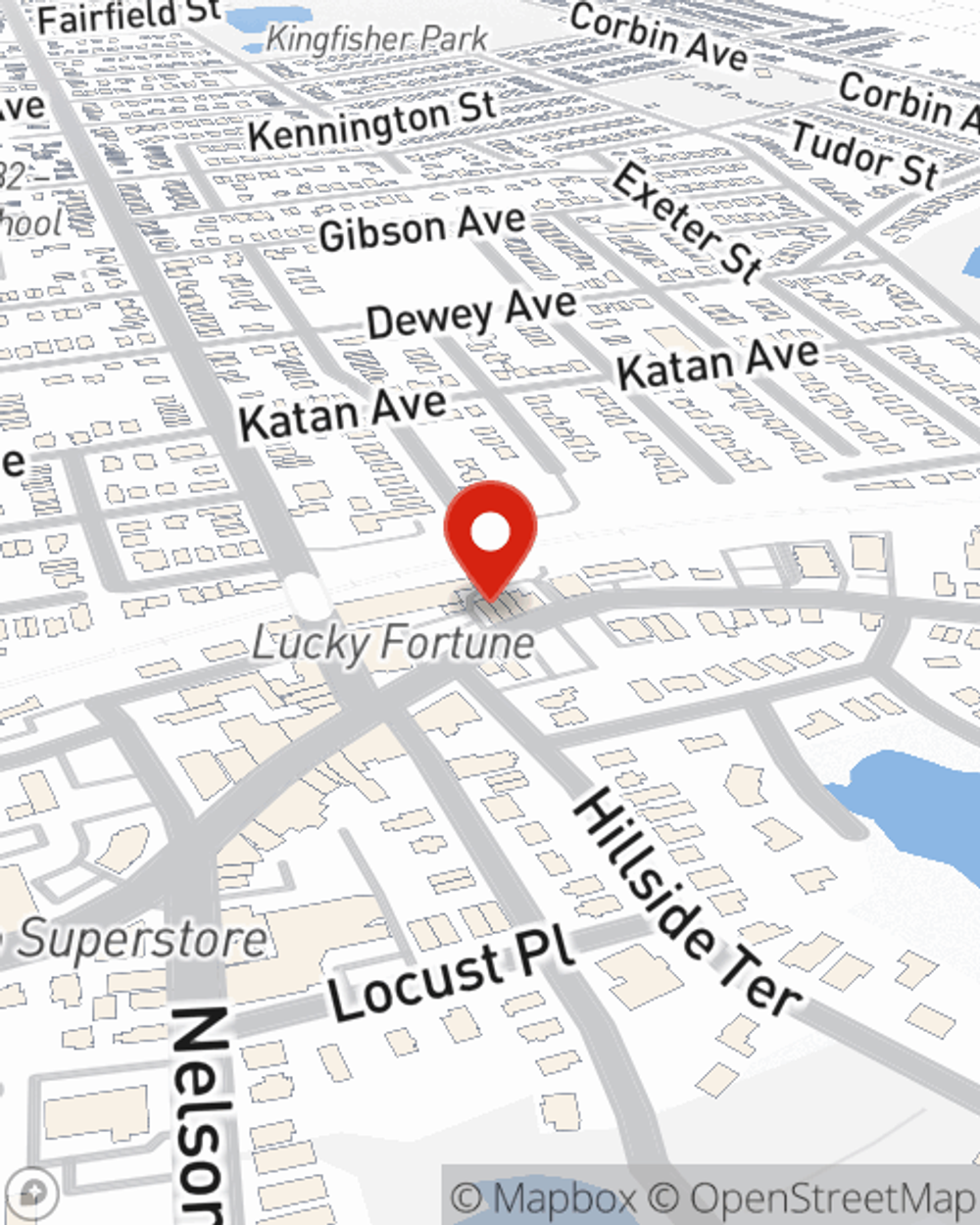

Dominick Abramo

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.